From Debt to Riches: The Ultimate Financial Wellness Journey

Debt can feel overwhelming and make it difficult to see a way out. But with determination and a plan, anyone can turn their financial situation around and achieve financial wellness. The journey from debt to riches is not an easy one, but with hard work and perseverance, it can be done.

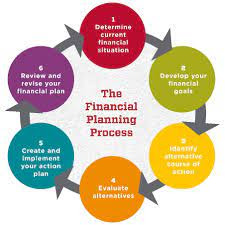

The first step in this journey is to take stock of your current financial situation. This means creating a budget and tracking your spending. Once you have a clear understanding of your current financial situation, you can begin to make changes. Start by cutting back on unnecessary expenses and finding ways to increase your income.

Next, focus on paying off your debt. This might mean making sacrifices, such as cutting back on entertainment or eating out less. But it's important to stay focused on your goal of becoming debt-free. Consider using the debt snowball method, where you focus on paying off your smallest debt first and then working your way up to the largest debt. This approach can help you see progress and stay motivated.

In addition to paying off debt, it's also important to start saving. Building an emergency fund is essential to protect yourself against unexpected expenses. This fund should have three to six months' worth of living expenses saved in it. In addition, consider saving for long-term goals, such as retirement or a down payment on a house.

Investing is also an important part of financial wellness. Investing your money allows it to grow over time, which can help you achieve financial freedom. There are many different types of investments, including stocks, bonds, and real estate. It's important to do your research and understand the risks associated with each type of investment before you begin.

One of the most important aspects of financial wellness is education. Take the time to learn about budgeting, saving, investing, and managing debt. This knowledge will give you the tools you need to make informed decisions and achieve financial success.

Discipline is also key to financial wellness. This means making smart financial decisions and sticking to your budget. It can be difficult to resist the urge to splurge on non-essential items, but it's important to stay focused on your financial goals.

Finally, it's important to have patience and perseverance. The journey from debt to riches is not an easy one, but with determination and a plan, anyone can achieve financial wellness. Stay focused on your goals, make smart financial decisions, and never give up.

In conclusion, the journey from debt to riches can be a challenging one, but with hard work and determination, it's achievable. Start by taking stock of your current financial situation, paying off debt, saving, investing, educating yourself, and having discipline. With patience and perseverance, you can turn your financial situation around and achieve financial wellness.

If you know more about, visit here

Visit here - https://wizely.in/wizeup/

Facebook - https://www.facebook.com/wizely.in

Linkedin - https://www.linkedin.com/company/wizelyapp/

Twitter - https://twitter.com/wizelyapp

Instagram - https://www.instagram.com/wizelyapp/

Comments

Post a Comment